Table of Content

The Government of India , through Nationalisation took over the shares of 55 Indian insurance companies and the undertakings of 52 insurers carrying on general insurance business. Eligibility For Loan AmountThe amount of loan repayment that you can afford to make every month. If you want to purchase a new property, buy one on resale, or construct a house from scratch, you can avail GIC Housing Finance Home Loan. Yes, your income can be clubbed with the income of your spouse to increase your eligibility if your spouse co-owner of property.

Will I get any tax benefits on GIC Housing Finance home loan? Yes, you will be entitled to receive tax benefits under Section 24 and Section 80C of the Income Tax Act. A maximum deduction of Rs.1.5 lakh from the income can be availed. In addition to the documents sought from all the housing loan applicants, they have to undergo elaborate paperwork to satisfy the needs at GICHFCL. GICHFCL offers a range of Home Loan schemes to cater to the variable needs of the customers. The most important feature is suggestive in the name itself and is applicable for all the loans covering the Salaried, Self-Employed, Professionals and the NRIs.

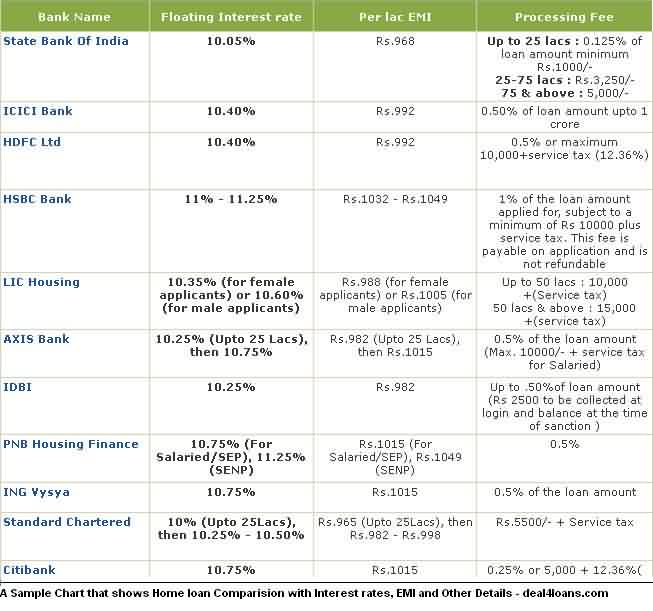

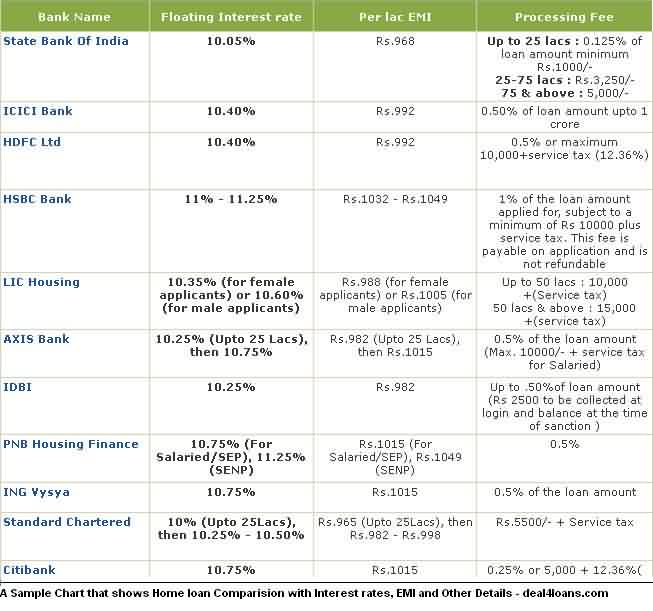

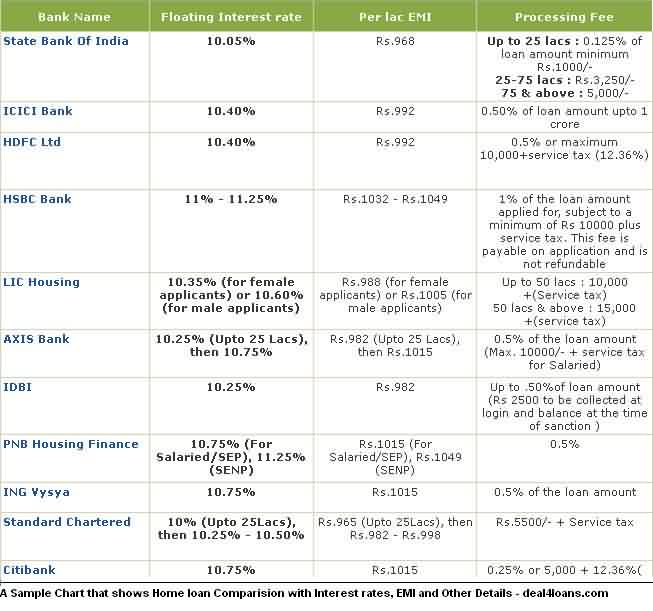

Latest Home Loan Rates Dec 2022

The beneficiary family consisting of husband, wife, unmarried son and daughter should not own a pucca house. The family should not have availed of any assistance from any Government of India housing scheme. The age of the applicant should be between 18 years to 60 years for salaried and 18 years to 70 years for the self-employed. A good credit score with a minimum of 650 to 750 is stipulated.

GIC Housing Finance offers various types of home loans and its eligibility also depends on the type of loan. For more details you can contact GIC housing finance customer care number by calling or visiting your nearest branch. You are also given tax benefits on home loan by this institution. If you fulfill all the conditions of this home loan, then you will get attractive loan from the bank.

More GIC HOUSING FINANCE LTD Home Loan Reviews

The builder and bank had a tie up with GIC housing and he recommended me about to take the home loan from them. I have received the loan on time and the service has been good. Not to be confused with a guaranteed investment contract, with which it shares the acronym GIC, a guaranteed investment certificate is a financial product in Canada. Guaranteed investment certificates are sold by Canadian banks, credit unions, and trust companies, often to individuals for their retirement accounts. In some of the conditions, you need to transfer your home loan to another bank for this you only need to write an application to the GIV housing finance.

A bullet GIC is type of guaranteed investment contract where both the principal and interest are returned to the payor at some date in the future. No, there is no federal insurance for guaranteed investment contracts, unlike certificates of deposit, many of which are covered by either the Federal Deposit Insurance Corporation or the National Credit Union Administration. In retirement plans, GICs typically appeal to risk-averse investors or those who want to balance out their portfolios by putting some of their money into a low-risk account. GICs are often offered to retirement plan participants as part of a stable value fund or similarly named conservative investment option.

Affordable Interest Rates

This type of home loan is given against property and is simed at solving only the commercial purpose of the borrower. The maximum loan amount sanctioned for this type of scheme is 50 Lakhs, against floating rate of interest. The applicants, in this scheme do not have the facility of Step up/Step Down or Zig Zag Mode of Payment. The minimum and maximum tenure of repayment for such type of loan is 5 to 10 years.

On doing that your EMI will be calculated and shown to you, along with the total interest payable and total amount payable on the loan. Documents required for sanction of loanIncomeSalariedEmployment certificate from the employer as per Form 22Self EmployedITR of the last two years with computation. Your one-stop facility to seek assistance for a home loan application is Housing.com. Keeping their prime objective in focus, GIC Housing Finance Limited takes pride in the fact that they offer tailor-made home loan schemes. Their products in home loan solutions cover all possibilities of home ownership, making them one of the key players in the home loan market. In case your installments are to be deducted directly from your salary, you need a letter from your employer confirming this arrangement, and remitting the amount directly to us.

GIC Housing Finance Home loan documents required

There is an elaborate roster of fees, and charges applied by GICHFCL in their home loan products. The details are enumerated below for an understanding of the overall cost of capital. Earlier I was staying in a rental property, and owning a house was just a dream. I am extremely grateful to GICHF team for sanctioning my loan under the PMAY scheme. Home loan Interest rates starts from 6.90% for women, 6.95% for Others. Example – if you take Rs. 12 lakh of loan amount at 9.20% interest rates, pre-calculated home loan monthly EMI are given below.

It's all bank's duty to do all verifications aand they take fees for that. On and above that they ask commission to process the request. Send like bribery is allowed here in the name of commission and everyone has their part in that.

Outstanding liability of the existing home loan plus Rs. 10 lakhs as a mortgage loan. I am using the home loan with the GIC HOUSING FINANCE LTD since from last 2 years, the documentation process was simple and easy to get the loan. The loan amount was good and also the rate of interest was nominal with this loan and comfortable to use.

Provide the loan amount, tenure and the rate of interest and the EMI will be calculated and displayed instantly. You can calculate the EMI with different combinations of the variables until the desired EMI is arrived at. The GIC Housing Finance Home Loan Interest Rate starts at 8.20%. The interest rate depends on the credit score of the applicant and so will be variable.

Security refers to the mortgage of you property, which you are planning to purchase, or of the plot, on which you are looking to construct a home or of already existing home when you are planning to renovate. The GIC Housing Finance provide many facility for own homes such as to take or purchase our house for this a home loan, to a home of own dream, renovating the old home into a complete new home. The following documents are required for GIC Housing Finance home loans. Copies of the documents mentioned below have to be submitted and originals have to be provided for verification only. Balance transfer of outstanding liability of home loans at other financial institutions is an option. Composite home loans are provided for the purchase of a plot and construction thereon.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. GICs typically appeal to investors who are either risk-averse or looking for a conservative investment to balance out the more volatile portion of their portfolio. Alexandra Twin has 15+ years of experience as an editor and writer, covering financial news for public and private companies. After clicking, all the information related to that home loan will come in front of you on the next page. You can take this GIC Home loan to do repairs/renovation of your home.

Even worst part is that, bank people do not know where the process is going on and nobody is responsible for any queries. I had my personal verification 2 weeks back and still bank said they've not received confirmation. When checked again they're saying that it's been sent in two folders. Don't know how could be so irresponsible they're that do not check their inbox. Frustrated and I'd never ever go for this bank and suggest to anyone.

No comments:

Post a Comment